How to Improve your ESG Investing: Powerful Partnerships for Sustainable Development Goals

“If you were to add a letter to ESG, what would it be?”

Without hesitation, the Mekong Club CEO, Matt Friedman, answered “P” for partnerships to introduce ESG(P).

Why?

Partnerships can improve ESG investing.

ESG investing trends have been mushrooming. According to a new Bloomberg Intelligence report, global ESG assets may exceed $41 trillion by 2022 and $50 trillion by 2025, accounting for one-third of total assets under management globally. Growing ESG future assets’ value indicates that they will be a significant asset class that all sustainable investors and financial institutions should now consider.

Yet, one challenge with ESG investing trends is the wide disparity in human rights ESG. While environmental and governance ESG metrics are well-established, social ESG metrics fall behind. There are no established criteria for assessing social factors associated with modern slavery.

Another hindrance is that ESG is company-centric. It evaluates individual organisations without emphasising their collaborative efforts. While some ESG indexes emphasise an organisation’s involvement in multi-stakeholder efforts, they play a minor role in the ESG framework. Endorsement and participation in sector-wide efforts are material enough to warrant consideration.

How to solve these issues?

The synergistic, unified, sector-wide partnership to integrating SDGs into ESG can help close the gap and bring up human rights ESG. The Business and Sustainable Development Commission estimates that achieving the United Nations SDGs will generate $12 trillion in market opportunities, attributing to around 60% of the global economy. Achieving SDGs’ enormous value reveals its profitability and potential.

The Mekong Club is at the forefront of standardising the modern slavery part of ESG social metrics in ESG investing. For example, in 2021, we held four events to amplify the ‘S’ in ESG, reaching 2,173 ESG data providers, sustainable reporting agencies, and asset managers.

And here’s what we came up with to achieve ESG(P) immediately.

Why integrate SDGs in ESG investing?

Linking SDGs and ESG investing trends can cultivate cross-sector collaborations and engagement, which benefits everyone. The linkage also provides you with direction to ESG social metrics.

Collective actions among prominent stakeholders such as governments, the United Nations, academic institutions, and civil society have been a hallmark for tackling SDGs. The SDGs are a collection of 17 interconnected global goals designed to be a “blueprint for achieving a better and more sustainable future for all”. The United Nations General Assembly established the SDGs in 2015 to reach them by 2030.

Yet, the SDGs were for policymakers and governments at the national level without emphasising private-sector partnerships.

One complexity of multi-sector synergy is that businesses need more incentives to engage in sustainable practices. Companies may regard sustainability as a “nice to have” for risk prevention and compliance but not a “must have” because it places little stress on the upsides of doing so.

To bring SDGs to the corporate level, we must combine them with ESG. ESG is a concept of active risk management that is financially relevant and can provide numerous long-term benefits to the company. Examples of advantages are employee and customer retention, access to ESG capital and cost savings. ESG also offers a tangible, measurable, comparable index that can reflect a company’s positive impact. Integrating with ESG can convert SDGs into a common goal to unite government, civil society, business, the United Nations, academic institutions, financial institutions, and public investors.

Merging SDGs goals into ESG investing would be a win-win for the world. Companies can enjoy stable profits and capital by engaging in human rights ESG. Investors and financial institutions can earn a long-term return by chasing ESG investing trends. Governments can help to promote long-term development that benefits the entire economy.

How to include SDGs in ESG investing?

Amplify ESG social metrics by integrating the SDGs structure into ESG indicators. We can create business indicators or KPIs of contribution to SDGs. Incorporating these indicators and KPIs into ESG investing indicators can enhance ESG social metrics measurement.

To combine SDGs into ESG social indicators, we must first understand the Modern-slavery-related SDGs for ESG social metrics:

- 2 Eliminate all forms of violence against all women and girls in public and private spheres, including trafficking and sexual and other types of exploitation.

- 7 Take immediate and effective measures to eradicate forced labour, end modern slavery and human trafficking and secure the prohibition and elimination of the worst forms of child labour, including recruitment and use of child soldiers, and by 2025 end child labour in all its forms.

To formulate the two SDGs into the ESG investing framework, we apply BlackRock’s investment framework to measure SDGs in relevance, completeness, and prioritisation to improve ESG investing:

- Relevance: To transform national goals into business indicators, we offer the below framework relevant to staff, procurement, recruitment, supply chain procedures and leadership efforts in anti-slavery.

- Completeness: Our framework includes multifaceted tangible and measurable human rights ESG practices to follow the completeness principle.

- Prioritisation: Our framework prioritises strengthening the impactful part of the business by focusing on supply chain sustainability, which is critical to a company’s success and reputation. Furthermore, the two SDGs are crucial to our economy, as the current and projected costs of inaction on gender equality and worker-related hazards are 18.5% and 3.9% of global GDP, respectively.

So what are the criteria of our ESG investing framework?

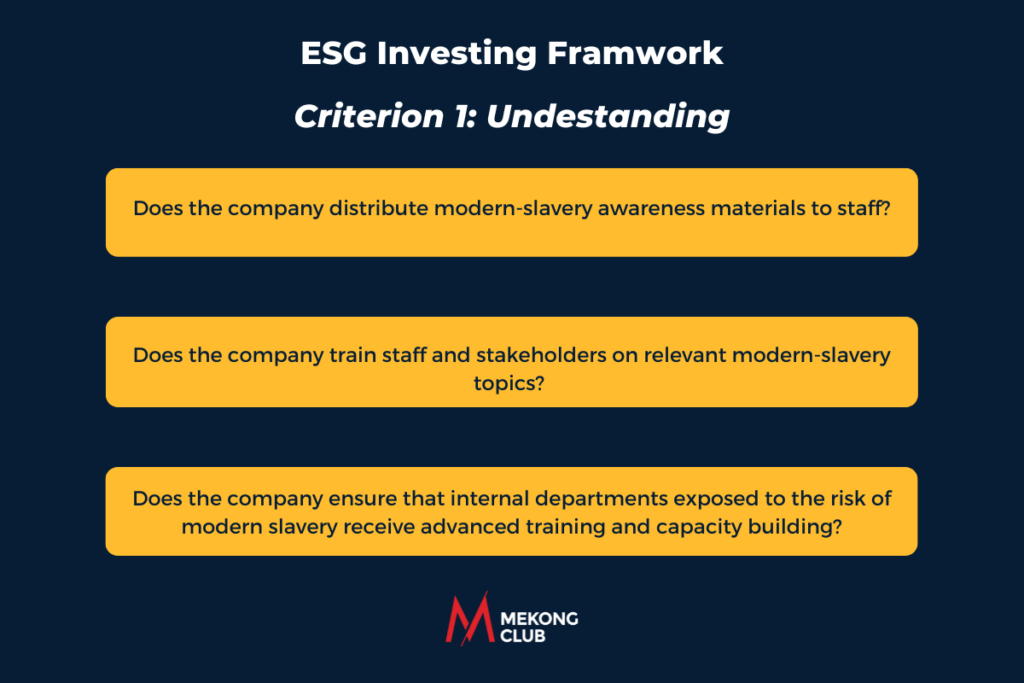

1. Every action begins with awareness, so the first criterion is Understanding. Companies should have materials, training, and capacity building for all stakeholders in the company, including staff, suppliers, and contractors, to improve organisational knowledge about modern slavery.

2. Knowledge is futile without action, whereas commitment is the first step toward action. So Commitment is the second criterion. Implementing supply chain policies and standards visible within the company and the public can foster company-wide dedication to modern slavery. Many businesses use third parties in their supply chains, but risks arise when things are hidden in plain sight. Therefore, practical supplier policies and contracts with standards are essential to guarantee slave-free supply chains.

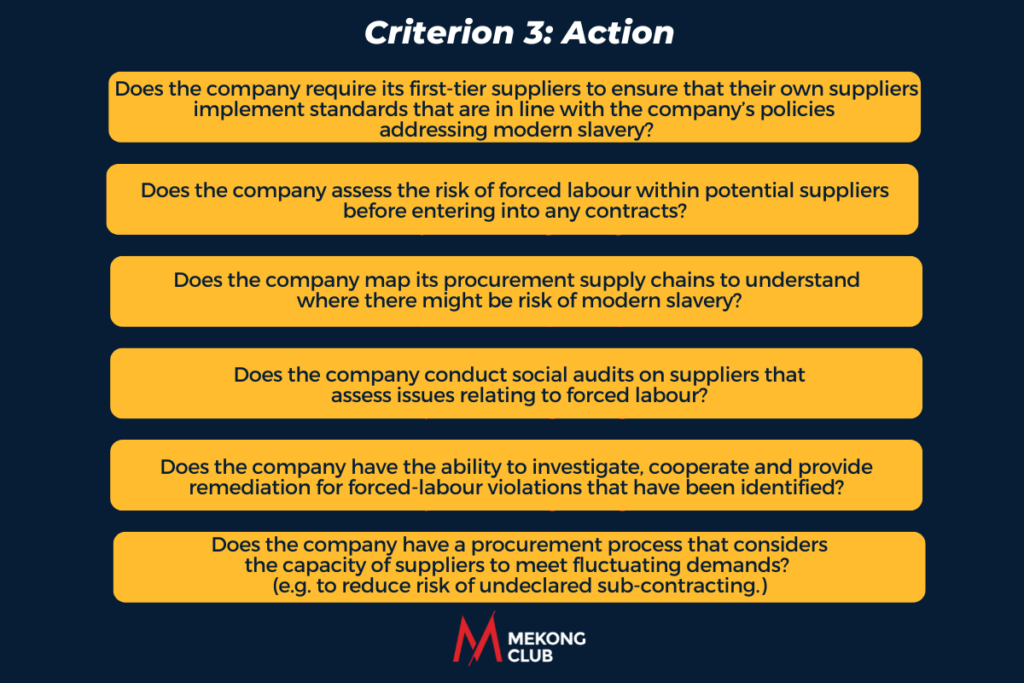

3. The next step in demonstrating commitment is to take action—are businesses achieving their promises to end modern slavery? Because many companies only examine tier 1, our framework encourages businesses to be consistent in detecting modern slavery risks in different tiers of supply chains. Additionally, once they identify risks, they should have remediation practices enforced.

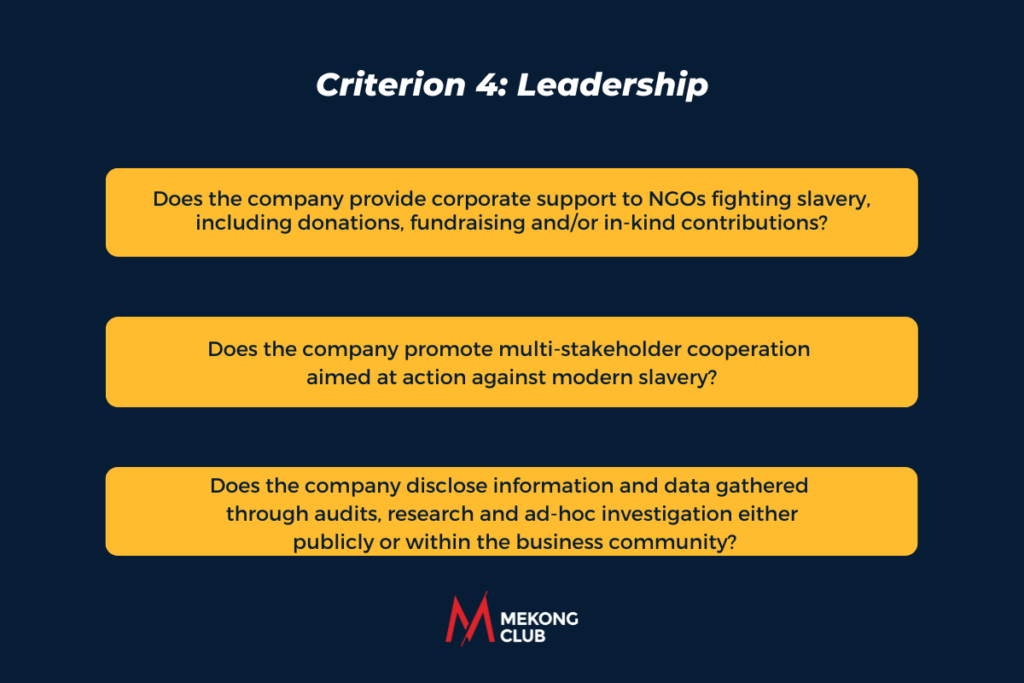

4. Businesses that go above and beyond to be leaders in the fight against modern slavery attract loyal customers who can help them achieve long-term success and sustainable development. Corporations should engage with NGOs, counterparts, customers, and others to promote comprehensive actions to end modern slavery.

The ESG concept and framework must be flexible and open to revisions. The flexibility would offer an increased, real-time impact on our collective desire to improve our world.

In conclusion, you need to pay attention to skyrocketing ESG investing trends. To sharpen ESG investing, we must strengthen partnerships, bridge the gap in human rights ESG, and develop social metrics ESG. Including the SDGs in the ESG framework is a perfect solution to ascertain the effectiveness of ESG investing.

Now we want to hear from you:

What do you think about integrating SDGs into the ESG investing framework? Let us know in the comment section below.

Want to receive personalised advice on how your financial institution can create an ESG framework that eases modern slavery? Contact us for a no-commitment and expert consultation here.

Authors: Matt Friedman and Tsz Yin Wong