The Many Faces: Ending Modern Slavery in Finance

The finance world is multi-faceted, and any one bank can employ thousands of staff, each with their own personal responsibilities and interests to fulfil. When we first engage with finance professionals on the topic of modern slavery risk, they often hold preconceptions about who in their organisation is responsible for addressing this crime or may lament over the fact that despite their interest in ending modern slavery, they do not have any personal leverage to do so. In fact, the Mekong Club has collaborated with a spectrum of finance professionals, and we have come to learn that there is no one person or team within any bank that is solely responsible for the modern slavery strategy. Addressing modern slavery in the finance world involves the cooperation and drive of a tapestry of people, each using their unique influence and knowledge to add to the collective response. Below is some information about the key roles and how our self-assessment can help you as a finance professional to understand the part that you have to play in ending modern slavery.

The Chair of the Board

The chair of the board, or equivalent highest level of management within a bank, is expected to set the tone of modern slavery compliance from the very top tier of the organisation. This is important as banks are often siloed between countries, departments, and business lines. Having a clear and consistent message from the top with regards to the bank’s standards and expectations related to modern slavery risk can ensure consistent approaches across the various siloes within any organisation. Banks that are required to produce modern slavery statements, such as under the UK or Australian modern slavery acts, often require the chairman or equivalent to sign the statement. These signed statements are publicly documented and state the company’s stance on modern slavery as well as a set of tangible actions and future commitments that will take place to address the issue. When staff within an organisation see such public statements endorsed by the highest level of leadership, a sense of collective responsibility is established. The chair and other senior leaders therefore have a responsibility to remain abreast of the company’s anti-slavery strategies and demonstrate public commitment to the cause.

The Anti-Money Laundering Compliance Officer

Anti-money laundering (AML) is perhaps one of the most immediate roles that comes to mind when considering who is on the front line of modern slavery prevention. Modern slavery, and related crimes such as human trafficking, are predicate crimes for money laundering and considered to generate at least 150 billion USD annually. Modern slavery is a highly lucrative crime for those involved because one can profit from the exploitation of another human being time and time again. The low-risk, high-reward nature of this crime perpetuates its growth. The anti-money laundering compliance officer is directly responsible for putting in place the safeguards to prohibit the criminals that profit from this crime from accessing financial systems. They create the systems and procedures required to scrutinise new and existing customers, incorporating modern slavery risk factors and modern slavery typologies into the process. They ensure that suspicious reporting procedures are developed and maintained to allow staff to safely and easily report unusual activity. They may oversee the risk assessment framework, ensuring that all crimes, including modern slavery, are part of a comprehensive risk assessment process. The AML compliance officer therefore plays a crucial role in setting the tone across all AML teams and the organisation as a whole – a tone of zero tolerance in allowing access to financial systems for the criminals who exploit other human beings for profit.

The Training Manager

Staff within any financial institution are continually learning, whether that be about new policies and procedures, new risks and trends, or customer service strategies. Training and capacity building form an integral part of any staff member’s workload and is often directly pinned to annual deliverables and KPIs. The team responsible for developing and implementing training therefore have a vital role to play in educating staff on modern slavery compliance and the roles that each department has to play in addressing this crime. Training must be informative and engaging and ideally refreshed on a regular basis to ensure knowledge retention and to account for new information and trends in the modern slavery space. As this crime is ever-evolving, up-to-date training is necessary for effective action against modern slavery risk. There are a wealth of modern slavery experts on hand to deliver in-house training for those teams with specific responsibilities which can further enhance engagement with this topic. Knowledge is power, and the training manager has the influence to leverage this power towards ending modern slavery.

The ESG Investment Manager

ESG investing involves considering ‘Environmental, Social, and Governance’ factors alongside financial factors when considering making an investment decision. Companies and investments can be rated using a range of ESG metrics which seek to score their activity in the three areas and reward those organisations that are making a positive change. Incorporating modern slavery indicators into ESG investments is increasingly expected, and there is a need for clear and measurable metrics in this space. ESG investment managers have a role to play in ensuring that their approach to ESG is holistic and includes modern slavery indicators. This ultimately will serve to encourage positive action, better modern slavery reporting standards, and a greater focus on the positive impact that investments can have on ending modern slavery. The ESG investment manager has the leverage to change how the world prioritises addressing modern slavery.

The Customer Relationship Manager

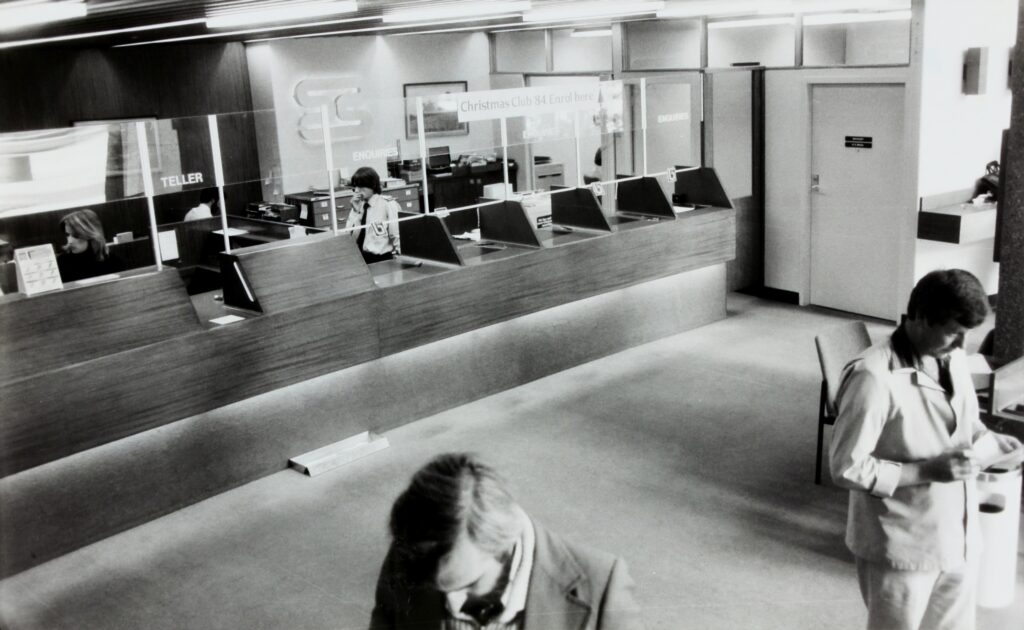

While analysing data may be one means to identify modern slavery risk, it is often the human interaction and intuition that can lead to the identification of modern slavery in daily life. Victims of modern slavery are found working in nail salons, car washes, construction sites and factories, and some are even taken into bank branches by their traffickers to open bank accounts that will be taken from their control. Relationship managers and branch staff have a unique opportunity to interact with their customers through making transactions, opening accounts or visiting their business premises as part of routine customer service. Modern slavery red flags that may be identified by frontline staff include victims being taken to open bank accounts with their trafficker posing as an interpreter, handling all paperwork and account cards, and speaking on behalf of the supposed account owner. Other modern slavery red flags include high-risk industries such as nail salons populated by staff showing signs of neglect, who may be fearful to interact, or whose business premises may show signs of secondary use as brothels, often tied to unusually high income levels in the form of cash. Customer relationship managers and other frontline staff are the eyes and ears needed to identify potential modern slavery victims and perpetrators.

The Procurement Manager

Banks have their own supply chains and have staff responsible for procuring a range of suppliers, services, and contracted staff. This area of risk exposure may not be one that immediately springs to mind when considering modern slavery risk as it relates to the finance industry, and yet overlooking modern slavery procurement risk could lead to modern slavery being found in the very office buildings used by the bank or in the supply chains of staff uniforms. Modern slavery is prevalent within low-paying jobs with high migrant worker populations, such as security guards, cleaning staff, refuse management, and catering staff. These workers may be coerced into employment through debt bondage perpetuated by high recruitment fees, threats to their families, and fraudulent employment contracts. Often in the case of banks, the hiring and management of such staff are outsourced to third-party labour providers, so the bank may not have direct oversight of the true working conditions of these employees despite their everyday presence in offices and branches across the bank’s network. Similarly, supply chains for branded merchandise and staff uniforms may carry modern slavery risk, and procurement teams have responsibilities to ensure that their suppliers are risk assessed and adhere to their expectations regarding modern slavery. The procurement manager has the power to ensure that modern slavery is not hidden in plain sight.

You!

There are many more people within finance that play a crucial role in addressing modern slavery. If you are a finance professional, take our Anti-Slavery Scorecard Self-Assessment to see how your company compares to others in the finance industry and learn more about the key role that you have to play in ending modern slavery.

Author: Phoebe Ewen